MSFT is likely to maintain its upward trend, with prices expected to climb steadily. Not surprisingly, if we observe expansion motivated by fresh IT sector acquisitions or advances.

Microsoft (MSFT) Price Prediction & Microsoft Stock Predictions (2025–2030)

+

Table of Contents

- 1 MSFT Predictions: Five Days, One Month, Three Months: An Instant View

- 1.1 Microsoft Stock Predictions’ Current Mood: Fear & Greed Index

- 1.2 Green Days against Red Days: a Mixed Bag

- 1.3 Long-Term MSFT Stock Forecast: Path to 2025, 2030, and Beyond

- 1.4 Starting the Year Strong: Feb–Mar 2025 MSFT Stock Forecasts

- 1.5 Spring through Summer: Apr–Jun 2025

- 1.6 Summer to Fall: Jul–Sep 2025

- 1.7 Oct–Dec 2025: The Final Stretch

- 1.8 Microsoft Stock Predictions 2026–2030: The Long-Term Project

- 1.9 Is it time right now to make Microsoft Stock Predictions investments?

- 2 Analyzing Risk

- 2.1 Final Thoughts:

In Short:

- Microsoft Stock Predictions forecasted to be steadily growing from $408.96 to $587.67 by December 2025, Microsoft (MSFT) presents a possible return on investment of 43.67%.

- Particularly in mid-to-late 2025, short-term Microsoft Stock Predictions point to oscillations with minor declines in early 2025 before a hopeful increase.

- Though long-term investor hope is high, the sentiment is still wary with a gloomy view of the immediate future.

If stock forecasts appeal to you, get ready! We will be delving into Microsoft Stock Predictions and projections from now until 2030 in this funky, simple tutorial. We will dissect the 2025 forecasts to provide an analysis of the wider market view, possible gains, and pricing trends. So grab your preferred snack, and let’s start this stock ride!

MSFT Predictions: Five Days, One Month, Three Months: An Instant View

Let’s first focus on some short-term projections for MSFT stock before delving into the long-term forecasts:

- We anticipate MSFT to reach $412.05.

- By the end of the month, Microsoft is expected to decline to $397.50.

- Fast forward three months, and MSFT might reach $426.04—perfect for those of you trying to hang on for a little bit.

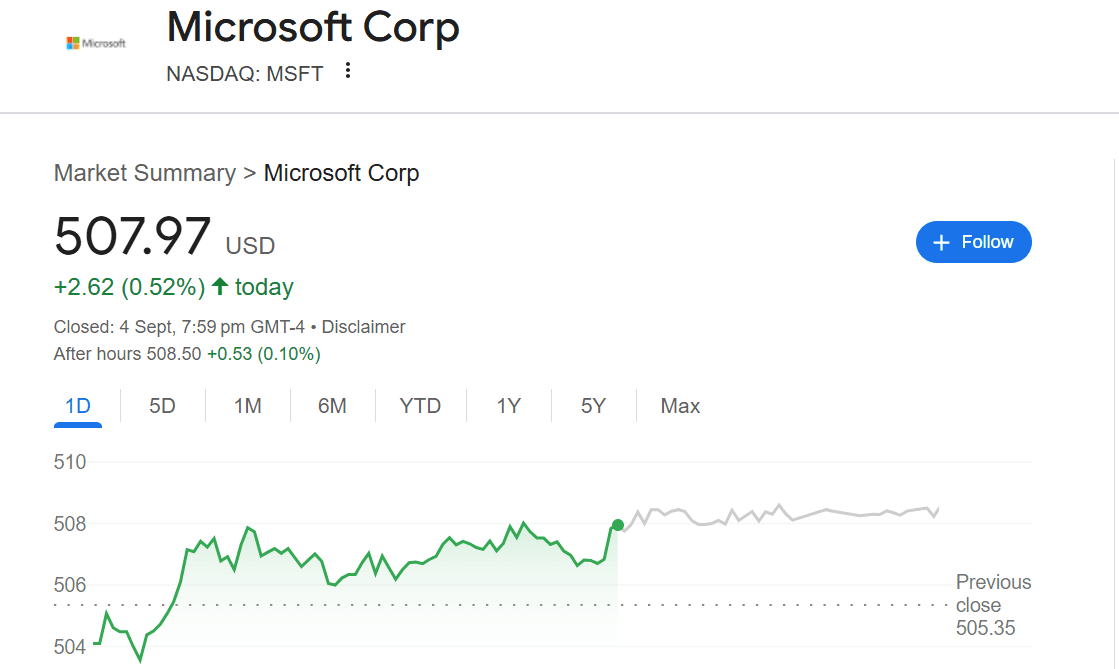

Currently, the stock price stands at $408.96, but the outlook for the near future is not promising. With a forecast of -4.41%, MSFT remains in the “bearish” zone, reflecting a fear-driven market attitude.

Microsoft Stock Predictions’ Current Mood: Fear & Greed Index

Let’s talk about mood, as the market’s fluctuations truly define everything. Currently reading 39, the Worry & Greed Index shows more market worry than greed. Investors are more wary, and MSFT has lately come under some strain. Regarding volatility, it’s 2.37%; therefore, the price has been moving rather a lot in the previous 30 days—perfect for individuals who enjoy the excitement of the ride but not ideal if you’re risk-averse.

Green Days against Red Days: a Mixed Bag

MSFT had fourteen green days out of thirty last month, meaning that 47% of the time it has been in the green. Still, it is not precisely a party. Given more red days than green, the stock is displaying some weakness.

Long-Term MSFT Stock Forecast: Path to 2025, 2030, and Beyond

After we have the short-term emotions under control, let us enlarge and consider what Microsoft has ahead from 2025 to 2030. The lowdown is as follows:

Starting the Year Strong: Feb–Mar 2025 MSFT Stock Forecasts

February 2025: With an average price hanging about $406.56 and a 2.45% possible return on investment, Microsoft could start February with. We expect the pricing to range from $392.94 to $419.04. Though not too large, the start is excellent and consistent.

March 2025: There might be some upward momentum here. With the stock maybe reaching $427.34 at its peak and declining to $399.81 at its lowest, analysts project a 4.47% possible ROI. This provides a favorable window for anyone wishing to ride the upward momentum.

Spring through Summer: Apr–Jun 2025

With pricing between $424.42 and $445.13, April 2025 might bring a strong 8.82% ROI. For those with a longer-term plan, this looks to be a decent month to start.

With an average of $424.52, Microsoft may be trading between $415.35 and $432.12 in 2025. Despite being less aggressive than April, we predict a potential gain of 5.64% this month, which is still in the correct direction.

June 2025: Maybe it’s the month things start to heat up? The projection shows a rise to about $450.33, with the possibility to fly as high as $476.84. This is a perfect month for growth-seeking investors since a 16.58% possible return on investment is hardly worth sneezing at.

Summer to Fall: Jul–Sep 2025

With a range of $469.42 to $486.31, MSFT might reach $477.35 in July 2025. With an 18.89% return on investment, the IT behemoth would be indicating a robust summer.

With an expected 27.05% ROI, August 2025 could be precisely the ideal month for MSFT. With prices anticipated to be between $483.91 and $519.67, there are some really strong positive signals.

Sep 2025: Following the increasing trend, September might see MSFT’s average jump to $502.16. Investors might get a 25.28% ROI from the expected trading range, which runs from $487.89 to $512.42.

Oct–Dec 2025: The Final Stretch

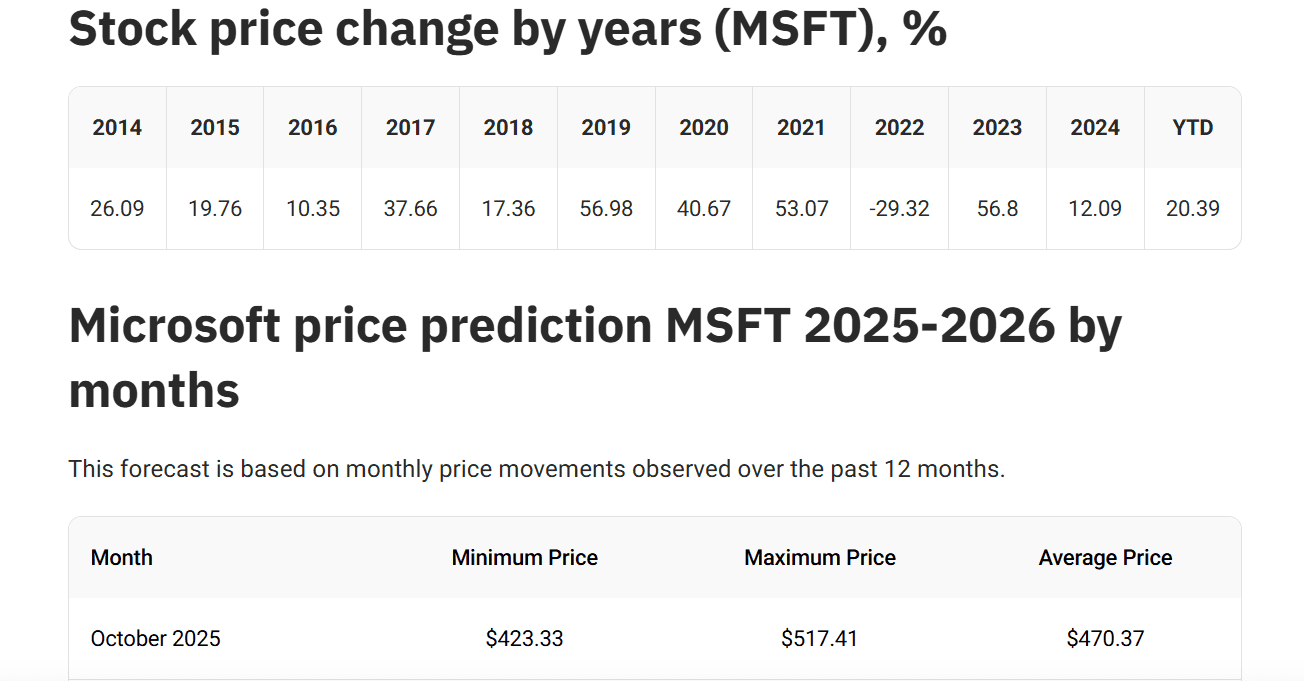

October 2025: With an expected ROI of 39.04%, Microsoft could be experiencing significant growth by October. As we approach the end of the year, the expected price range—between $493.81 and $568.71—showcases a steady increase.

November’s projection in 2025 seems much better! With an expected range of $557.63 to $587.67, MSFT might touch $573.70, offering a possible 43.67% ROI. If you have been waiting for this, it could be a satisfying reward!

Microsoft’s year-end projection for 2025 falls between $548.54 and $584.10; the stock price is projected to be almost $566.07. December is anticipated to finish the year spectacularly with a 42.80% possible return.

Microsoft Stock Predictions 2026–2030: The Long-Term Project

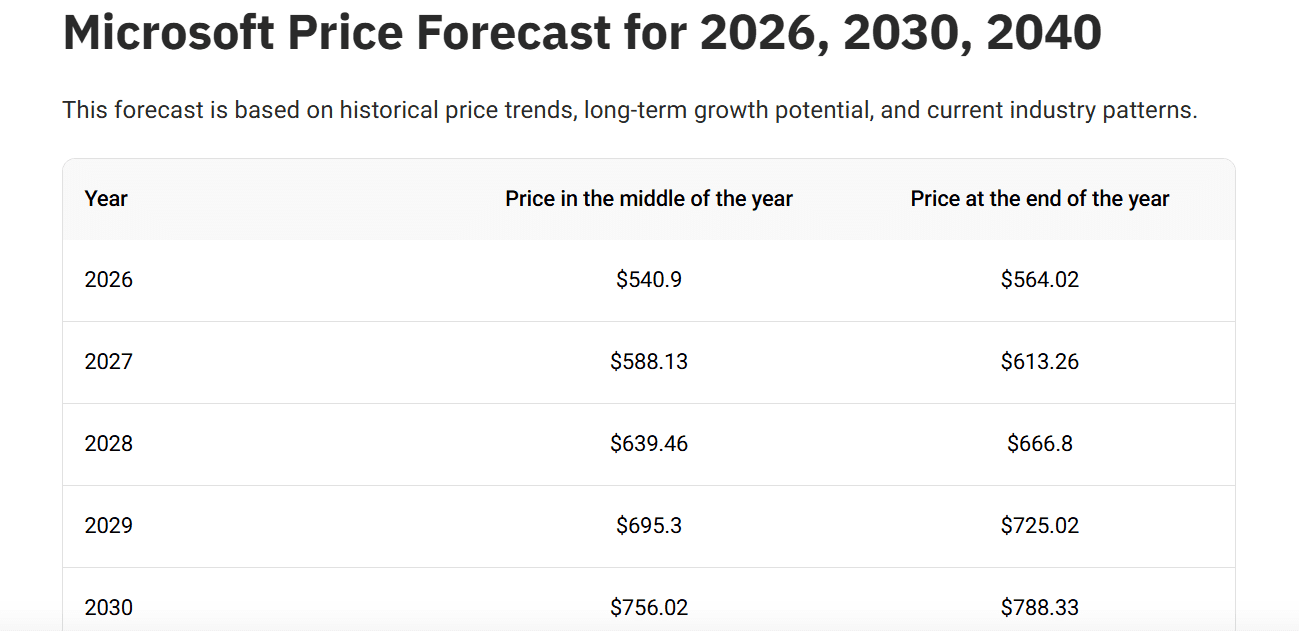

What, then, do the years ahead hold? Between 2026 and 2030, MSFT stock has the following overall picture:

2026:

2027: Riding the tech wave, the stock could be profiting from cloud services and artificial intelligence. Prospect for expansion seems strong.

2028–2030: Microsoft may be leading tech innovation by the end of 2030 with appreciable price increases. With further market penetration and income from younger sources, expect the stock to maybe double from its 2025 levels.

Is it time right now to make Microsoft Stock Predictions investments?

- ShortTerm: ShortTerm It’s most likely not the finest time if you’re hoping for a quick play. Given that MSFT is trading somewhat above the projection, the market is displaying indicators of anxiety and caution, and may be somewhat overpriced.

- Long-Term: Microsoft might still be a favorable target, though, if you are a long-term investor looking forward to 2025 and beyond. As we have shown, the stock has great room for expansion in the next months and years.

Analyzing Risk

The market is more scared than hopeful, as the current attitude is pessimistic. But MSFT clearly has lasting power, with a 47% green-day trend over the past month. Still, it’s important to monitor volatility—especially since tech stocks can fluctuate dramatically over brief times.

Final Thoughts:

Microsoft (MSFT) is displaying conflicting short-term signals, but with a favorable long-term view, there is a lot of space for possible development. For those ready to wait for the larger payback, MSFT could be a good choice, with a prospective 43.67% return in November 2025 to strong forecasts for 2030.

Please Note: This is only a fun, educational overview of MSFT’s possible course; it is not investment advice. Before deciding on any investment, always perform your own investigation or see a financial adviser. Regardless of your level of fear or slight greed, remember that Microsoft has a long road ahead and could be among the most fascinating stocks to watch over the next ten years.