Upcoming Fintech Apps: Fascinating New Apps Changing the Rules

- 1 Let’s Explore Some Of The Most Innovative Upcoming Fintech Apps

- 1.1 X Money: The Revolutionary Payments Vision of Elon Musk

- 1.2 Silbo Money: Via WhatsApp, Because Why Not?

- 1.3 TigerGPT: AI-Powered Investment Help

- 1.4 Revolut’s Foray into Mortgages: The audacious action of a digital bank

- 2 Transformation of Upcoming Fintech Apps

- 2.1 Personalized Wealth Management at Your Fingertips Powered by AI-Powered Robo-advisers

- 2.2 Decentralized Finance (DeFi) is redefining financial services, devoid of banks

- 2.3 Embedded Finance: Including Financial Services into Your Preferred Apps

- 2.4 Super Apps: One App to Rule Them All

- 3 Conclusion

- Upcoming Fintech Apps have a bright future; these apps represent only the tip of the iceberg.

- Even more innovation will be expected as 2025 draws near, bringing financial services right into consumers’ hands in fascinating and unanticipated directions.

- Artificial intelligence is being used more and more in FinTech apps since it provides tailored services

The financial technology (FinTech) sector is going through a seismic change as fresh ideas born this year redefine our financial management. These developments are not only enhancing current systems but also generating whole fresh approaches to engage with and grasp financial services. Upcoming Fintech Apps are getting smarter, faster, and more user-friendly than ever in 2025 and forward.

Let’s Explore Some Of The Most Innovative Upcoming Fintech Apps

X Money: The Revolutionary Payments Vision of Elon Musk

Elon Musk has never been one to hold back on huge ideas; his most recent endeavour, X Money, is no different. Looking to completely avoid conventional banking infrastructure, this creative payment platform is poised to change the way we make transactions. X Money employs cutting-edge technology, including blockchain and cryptocurrencies, instead of depending on conventional bank accounts to enable flawless, immediate transactions all around. X Money is more than just another payment app as we head toward 2025; it might represent the future of financial transactions, offering a worldwide, dispersed network for value-exchanging individuals. If you enjoy innovation, this is one app you should keep under observation.

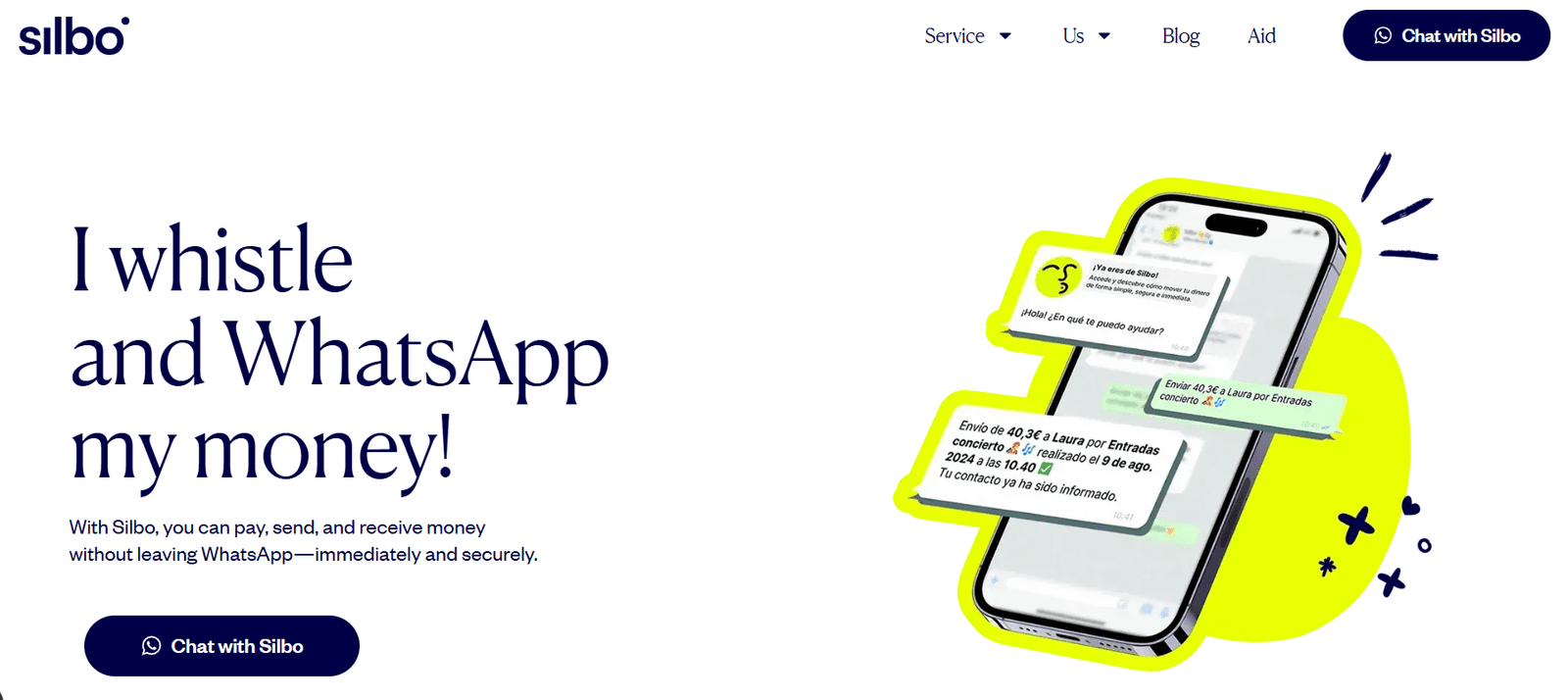

Silbo Money: Via WhatsApp, Because Why Not?

Given that messaging applications are becoming a part of everyday life, it is logical that they would finally serve as venues for financial transactions. Now, enter Silbo Money, a novel new tool introducing payments to WhatsApp. You did read correctly. One of the most often used messaging programs worldwide, WhatsApp will soon let you send money, pay bills, and even buy goods straight through.

Using WhatsApp’s worldwide reach and easy interface, Silbo Money offers a straightforward, safe payment option free of separate banking apps or complicated registration requirements. All within an app you already use to remain in touch with friends, family, and colleagues, it’s a simple approach to handling your money.

TigerGPT: AI-Powered Investment Help

Imagine having an artificial intelligence-powered assistant right now who can help you make better investment decisions by analyzing the stock market and generating forecasts. TigerGPT, an upcoming software by Tiger Brokers, integrates DeepSeek’s cutting-edge AI model into its platform to deliver on this promise.

Revolut’s Foray into Mortgages: The audacious action of a digital bank

With its creative attitude to personal finance, the digital banking powerhouse Revolut has already created waves. The business is now focusing on mortgages, a new front line. Starting in Ireland, Revolut will be introducing mortgage solutions across Europe in 2025 in order to increase its offers and challenge the established mortgage sector.

Transformation of Upcoming Fintech Apps

- In a surprising move, Trump Media and Technology Group (TMTG) launched Truth. Fi, a new FinTech brand aimed at revolutionizing digital financial services. The app is scheduled to present a variety of financial items, including more crypto services and investment instruments. Truth. Fi, with a large investment of up to $250 million, seeks to carve out its position in the packed FinTech market.

- The emphasis Moneyview places on financial inclusion distinguishes it. With anything from rapid loans to tailored financial guidance, the app seeks to give underprivileged groups in India easily available financial services. Having lately attained unicorn status with a price of $1.2 billion, Moneyview is ready to keep developing and increase its user base.

- With intentions to increase its products and attract new consumers, Moneyview is presenting itself as one of the most exciting FinTech apps in India, looking forward to 2025.

Personalized Wealth Management at Your Fingertips Powered by AI-Powered Robo-advisers

- Rising in prominence as a substitute for conventional money management solutions are AI-powered robo-advisors. Without a human advisor, these systems use artificial intelligence to build customized investment portfolios, maximize tax strategies, and enable consumers to reach their financial goals.

- Leading players in this movement are sites like Betterment, Wealthfront, and Acorns, which provide reasonably priced automated financial guidance. By examining consumers’ financial circumstances, risk tolerance, and goals, these robo-advisors build tailored portfolios that maximize returns and lower risk.

- As artificial intelligence develops and improves robo-advisor capabilities, we should see even more innovation in this area in 2025. AI-powered wealth management tools are poised to make managing your money quick and easy, whether your savings are for retirement or stock market investment.

Decentralized Finance (DeFi) is redefining financial services, devoid of banks

- One of the most fascinating developments in the FinTech scene, decentralized finance (DeFi), is not slowing down anytime soon. DeFi systems seek to supplant established financial services with distributed alternatives free of banks or other middlemen.

- DeFi apps as Aave, Compound, and Uniswap, let users lend, borrow, trade, and profit on their digital assets using blockchain technology. Operating on smart contracts, these systems guarantee automated, transparent, and safe transactions. DeFi is a convincing substitute for those bored with dealing with banks that puts financial management under their control once more.

- Expect much more innovation in this area as the DeFi ecosystem expands since new platforms provide special means to manage wealth outside the conventional financial system, trade cryptocurrencies, and generate passive income.

Embedded Finance: Including Financial Services into Your Preferred Apps

- One trend driving financial services’ accessibility more than ever is embedded finance. Non-financial platforms like ride-sharing apps, e-commerce sites, and social media are rapidly integrating financial products into their services.

- For example, you could make payments or take out a loan directly through your favorite shopping app, or earn rewards from your ride-sharing app that can be reinvested or applied to future rides. People’s access to and use of financial services are being transformed by this smooth integration of financial products into regular applications.

- With more and more apps including financial capabilities that simplify money management, embedded finance should become even more common in 2025.

Super Apps: One App to Rule Them All

- Super apps are all-in-one platforms combining a broad spectrum of services—banking, payments, shopping, entertainment, and more—into one single app. Originally quite popular in Asia, these apps are starting to find popularity elsewhere as well. Super apps have already shown their power in apps like WeChat and Grab; in 2025, more FinTech firms are likely to use this approach.

- Super applications provide everything from ride-sharing services to peer-to-peer payments and even insurance products under the same platform, therefore simplifying user experiences. Super applications simplify user management of their whole financial and lifestyle ecosystem by grouping several services into one app, therefore avoiding platform switching.

- Super apps—which provide an all-in-one solution that streamlines your digital life—are the future of financial services if you value convenience.

Key Note: DeFi systems remove middlemen like banks, thereby allowing consumers more control over their money and chances for larger returns and more openness. Embedded finance is the trend of including financial services within non-financial apps, therefore enabling consumers to effortlessly handle their money inside the systems they now use.

Conclusion

The FinTech sector is poised to fundamentally rethink money, payments, and financial management for years to come using artificial intelligence, blockchain, or a simple interface with regular apps.