Optimizing B2B Cross-Border Payments for Seamless Global Transactions

- 1 Payment Gateways Integrations

- 2 Merchant of Record (MoR)

- 3 Best Practices for Optimizing B2B Cross-Border Payments

- 3.1 1. Understand Regulatory Landscape and Compliance Requirements:

- 3.2 2. Leverage Technology for Automation:

- 3.3 3. Choose the Right Payment Method:

- 3.4 4. Optimize Currency Exchange:

- 3.5 5. Consolidate Payments and Batch Processing:

- 3.6 6. Negotiate Favorable Terms with Financial Institutions:

- 3.7 7. Enhance Data Security:

- 3.8 8. Implement Transparent Fee Structures:

- 3.9 9. Monitor and Track Transactions:

- 3.10 10. Regularly Review and Update Processes:

As the world shrinks and companies stretch, B2B cross-border payments become the heartbeat of global commerce. But traditional methods, riddled with hefty fees and glacial speeds, threaten to choke this vital artery. By exploring the current roadblocks and unveiling cutting-edge solutions, we equip businesses to dance across the intricate terrain of international transactions, paving the way for a future where seamless payments fuel boundless growth.

This final iteration further condenses the language while retaining the core message. It uses imagery and strong verbs to create a more evocative and impactful tone, emphasizing the challenges and opportunities of navigating cross-border payments in a globalized world.

Payment Gateways Integrations

Payment gateways are payment processors that allow the processing of B2B cross-border payments. You would have heard of PayPal, Stripe, Braintree, etc. They are all payment gateways. They process payments locally and internationally. Many businesses integrate these payment gateways with their core systems to run business seamlessly.

Payment gateways offer multicurrency support so customers can pay in their local currency. It is an essential feature because it will directly affect your sales if you do not allow multicurrency support. Imagine you are living in the US and want to order something. However, the brand from where you are ordering only allows payments in British pounds. Will you still want to order from this brand? Many people will not make a purchase just because they cannot pay in their local currency. So that is the reason payment gateways and their local currency support are essential for businesses.

Payment gateways allow multiple payment methods support. And it is needed because not all customers will pay you with one payment method. Different customers prefer different payment methods. So, offer support for multiple payment methods, which is possible if you integrate payment gateways with your system.

Also, you need to go for multiple payment gateways. Now, why is that needed? Well, it is necessary because sometimes the server is down. Now, how would you process payments if that happens? In such situations, the other payment gateway you have integrated will help by allowing payment processing.

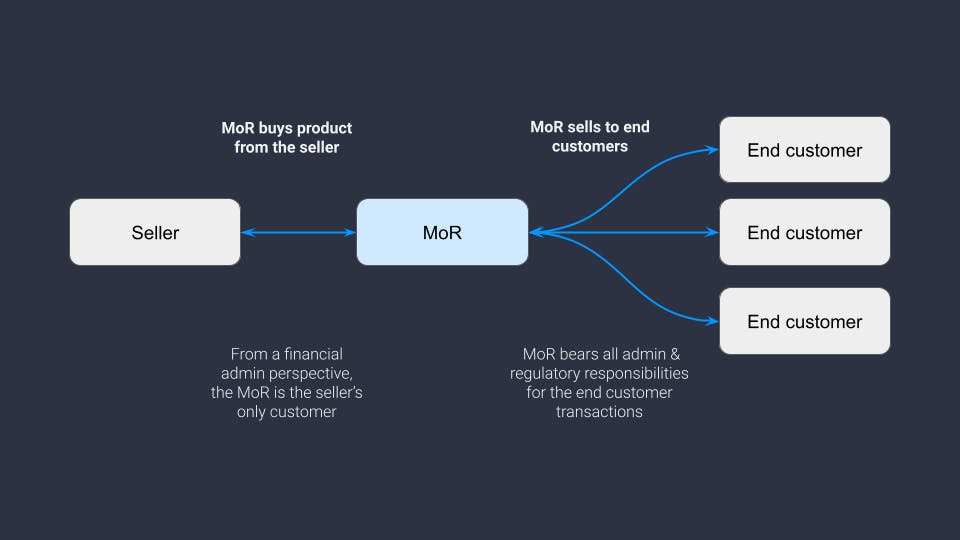

Merchant of Record (MoR)

In the e-commerce maze, the Merchant of Record acts as the financial navigator. The legally authorized captain is steering payments, transaction details, and compliance through the complex web of taxes, currencies, and regulations. This crucial role ensures smooth, secure journeys for buyers and sellers, simplifying digital commerce. By taking the financial wheel, the Merchant of Record empowers seamless online transactions, making the virtual market a playground for everyone.

What to Choose for Your Business?

Both payment gateways and Merchant of Record (MoR) offer payment processing. However, what you choose for online payment processing will depend on your business needs. It is better to jot down your business needs and decide on the payment processor accordingly.

The things on which you need to focus when deciding on the payment processor will be the following:

- The region where you need to make transactions

- The customers and their preferences regarding payment methods

- The local currency in which your customers want to pay

- Security compliance that you need to keep customer data secure

- Emerging trends and technologies that you would like to opt for

Best Practices for Optimizing B2B Cross-Border Payments

Here are some of the best practices for cross-border payment processing. You can also opt them.

1. Understand Regulatory Landscape and Compliance Requirements:

Complying with local and international regulations is paramount. Stay informed about tax laws, currency controls, and compliance requirements in both sender and receiver jurisdictions. This knowledge helps prevent delays fines, and ensures smooth transactions.

2. Leverage Technology for Automation:

Implement payment automation systems and use financial technology solutions to streamline cross-border transactions. Automation reduces manual errors, speeds up processing times, and provides real-time visibility into payment status.

3. Choose the Right Payment Method:

Evaluate different payment methods based on transaction speed, cost, and security. While traditional wire transfers are shared, newer options such as online payment platforms, blockchain, and digital wallets may offer faster and more cost-effective alternatives.

4. Optimize Currency Exchange:

Monitor currency exchange rates and choose the right time to convert currencies. Utilize hedging tools and forward contracts to mitigate the impact of currency fluctuations, reducing the risk associated with exchange rate volatility.

5. Consolidate Payments and Batch Processing:

Bundle multiple payments into a single transaction or use batch processing to reduce transaction costs. Consolidating payments can also simplify reconciliation processes and minimize the administrative burden.

6. Negotiate Favorable Terms with Financial Institutions:

Work closely with banks and financial institutions to negotiate favourable terms, such as lower transaction fees and better exchange rates. Building strong relationships with banking partners can lead to customized solutions and improved payment efficiency.

7. Enhance Data Security:

Prioritize data security and implement robust cybersecurity measures to protect sensitive payment information. Utilize encryption, multi-factor authentication, and secure communication channels to safeguard against fraud and unauthorized access.

8. Implement Transparent Fee Structures:

Clearly understand and communicate the fee structures associated with cross-border payments. Fee transparency helps budget, reduces surprises, and allows businesses to choose the most cost-effective payment methods.

9. Monitor and Track Transactions:

Establish a comprehensive tracking system to monitor the progress of cross-border transactions in real time. This ensures timely issue resolution, better cash flow management, and improved decision-making based on accurate financial data.

10. Regularly Review and Update Processes:

Stay agile by regularly reviewing and updating payment processes. As the global financial landscape evolves, businesses should be adaptive and open to adopting new technologies and methodologies that enhance efficiency and reduce costs.

By incorporating these best practices, businesses engaged in B2B cross-border payments can create a more resilient and efficient financial ecosystem, fostering growth and success in the international marketplace.