The Impact of Bank Account Aggregator Software on Financial Technology

In the rapidly evolving world of financial technology, the emergence of bank account aggregator software has been a game-changer. This innovative tool is reshaping how individuals and businesses manage and interact with their financial data. By offering a unified view of multiple bank accounts, these aggregators are not just simplifying financial management but are also driving significant changes in the broader financial technology landscape.

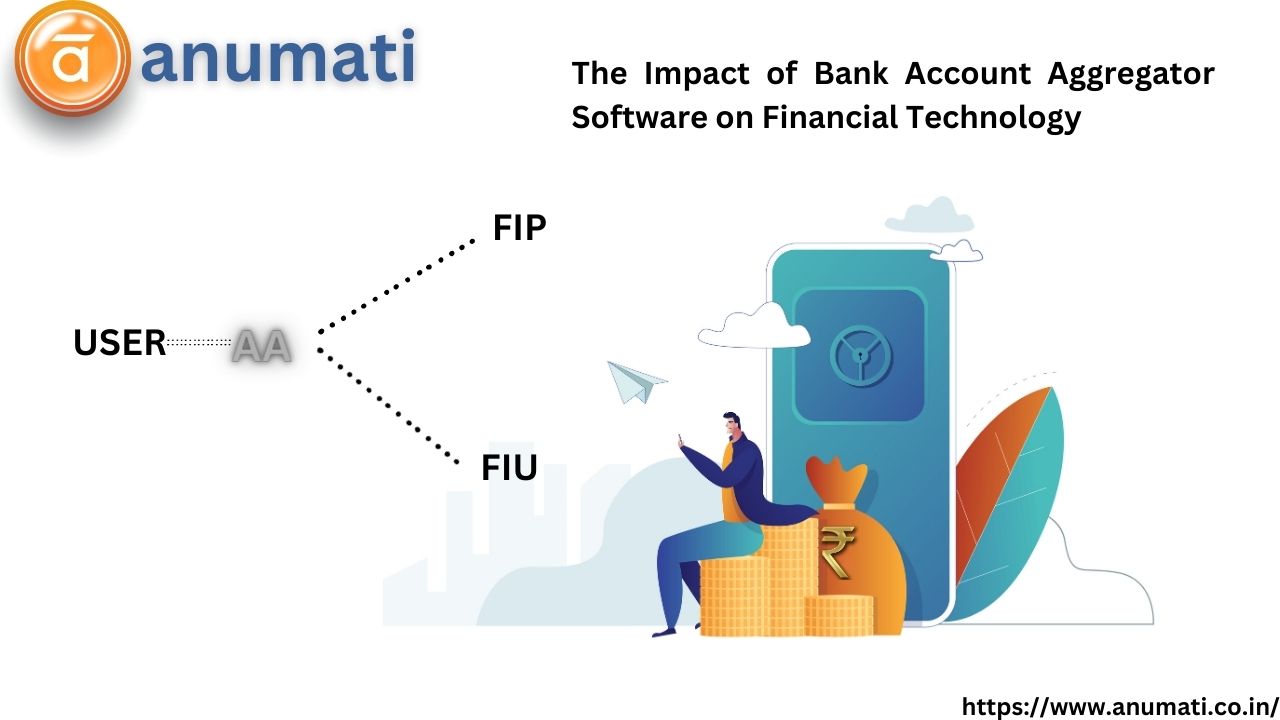

Understanding Bank Account Aggregators

Before delving into the impact of bank account aggregators, it’s crucial to understand what they are. A bank account aggregator is a software tool that consolidates information from multiple bank accounts into a single platform. This allows users to view balances, transactions, and other financial data from different banks in one place. The key benefits include:

- Enhanced Convenience: Users no longer need to log into multiple banking portals.

- Improved Financial Management: It’s easier to track spending, budget, and plan finances.

- Real-Time Data Access: Users get up-to-date information about their financial status.

Impact on Personal Finance Management

The integration of bank account aggregator software into personal finance management has led to several notable improvements:

Streamlined Financial Oversight:

- Centralized Account Management: Individuals can view all their bank accounts, including checking, savings, and credit cards, in one interface. This centralization simplifies the process of monitoring account balances and recent transactions across different banks.

- Time Efficiency: By reducing the need to log into multiple banking platforms, users save significant time, especially when managing numerous accounts.

- Reduced Risk of Overlooked Transactions: Having a unified platform minimizes the chances of missing out on important account activities, such as unauthorized transactions or unexpected fees.

Budgeting and Spending Analysis:

- Automated Expense Tracking: The software categorizes transactions from various accounts, making it easier to track where money is being spent.

- Visual Financial Insights: Many aggregators provide graphical representations of spending patterns, helping users quickly understand their financial habits.

- Customizable Budgeting Tools: Users can set specific budgeting goals for different categories, such as groceries, entertainment, or savings, and monitor their progress in real time.

Financial Planning:

- Long-Term Financial Health: With comprehensive data, individuals can analyze their spending and saving habits over time, leading to better financial decisions and planning.

- Goal Setting and Tracking: Users can set various financial goals, like saving for a vacation or paying off debt, and use the aggregator to track their progress.

- Informed Investment Decisions: Access to detailed financial information allows individuals to assess their risk tolerance and investment capacity, aiding in making smarter investment choices.

Revolutionizing Business Financial Operations

The introduction of bank account aggregator software has not only simplified financial management for individuals but has revolutionized business financial operations in several key areas:

Simplified Cash Flow Management:

- Enhanced Visibility: Businesses gain a comprehensive view of their cash flow across various accounts, aiding in more accurate forecasting and budgeting.

- Time Efficiency: The consolidation of financial information reduces the time spent on gathering data from multiple sources, allowing more focus on strategic decision-making.

- Identifying Trends: By analyzing consolidated data, businesses can identify spending trends and optimize their cash flow management.

Enhanced Financial Reporting:

- Automated Data Aggregation: The automatic collation of financial data from different sources streamlines the preparation of reports.

- Accuracy and Consistency: Bank account aggregator software ensures that the financial data is accurate and consistent, which is crucial for reliable financial reporting.

- Customizable Reports: Businesses can customize reports to focus on specific areas of interest, enhancing strategic planning and performance analysis.

Improved Decision Making:

- Data-Driven Strategies: Access to a comprehensive financial picture enables businesses to make well-informed strategic decisions.

- Risk Management: With better financial oversight, businesses can identify potential risks more quickly and take proactive measures.

- Growth Opportunities: A clearer understanding of financial health aids in identifying opportunities for expansion and investment.

Impact on the Banking Industry

The rise of bank account aggregator software has also influenced the banking sector in several ways:

- Increased Competition: Banks are now compelled to innovate and improve their digital offerings to retain customers.

- Partnership Opportunities: Many banks are partnering with fintech companies to offer integrated services.

- Data Security and Privacy: As aggregators gain popularity, banks are focusing more on ensuring the security and privacy of their customers’ data.

Challenges and Considerations

While bank account aggregators offer numerous benefits, they also present certain challenges:

- Data Security: Ensuring the security of sensitive financial information is paramount.

- Regulatory Compliance: Navigating the complex financial regulatory landscape is essential for these services.

- Reliability and Accuracy: The software must consistently provide accurate and up-to-date financial data.

Future Trends and Developments

The landscape of financial technology, particularly with the integration of bank account aggregator software, is on the brink of several exciting advancements. These developments not only promise to enhance the functionality of these tools but also aim to revolutionize the way we approach financial management and banking.

- Artificial Intelligence and Machine Learning: The incorporation of AI and machine learning into bank account aggregators is not just a futuristic concept but a rapidly approaching reality. This integration will enable the bank account aggregator software to offer personalized financial advice, adapting to individual user behaviours and preferences. For instance, AI can analyze spending patterns to provide tailored budgeting tips or investment suggestions.

- Blockchain Technology: The potential application of blockchain technology in bank account aggregators is another exciting development. Blockchain, known for its security and transparency, could add a layer of protection to financial data. This technology operates on a decentralized ledger system, making it nearly impervious to fraud and hacking. Implementing blockchain would not only secure financial transactions but also ensure the integrity and immutability of financial data.

- Expansion of Services: Current bank account aggregators primarily focus on aggregating data from various bank accounts. However, the future may see these platforms expanding their services to become more comprehensive financial management tools. This could include features like automated bill payments, subscription management, and even direct investment options from the aggregator platform. By turning into a one-stop financial hub, these tools could offer unparalleled convenience, allowing users not only to view but also to manage all their financial transactions from a single interface.

Conclusion

In conclusion, bank account aggregator software is significantly impacting financial technology. By offering a more streamlined and efficient way to manage financial data, these tools are not just enhancing personal finance management and business operations. Still, they are also driving innovation in the banking sector. As this technology continues to evolve, it is poised to play an even more integral role in shaping the future of financial services.